New American

November 1, 2013

In an October 30 press release, the Federal Reserve Bank’s Open Market Committee blamed the soft economy on a lack of government spending and announced it would continue the purchase of long-term federal debt and mortgage-backed securities indefinitely.

“Fiscal policy is restraining economic growth,” the Fed’s Open Market Committee (FOMC) concluded. The Federal Reserve support for “fiscal policy” as an economic cure — i.e., more government spending in an attempt to spur the economy through programs such as 2009′s “Cash for Clunkers” — may prove the FOMC to be the last bastion of the hard-core Keynesian economic school still on the U.S. political spectrum.

The statement came just one day before even the liberal Brookings Institution admitted that Obama’s Cash for Clunkers was an abysmal failure, where each “job-year” cost taxpayers $1.4 million. But the FOMC is still blaming the lackluster economy on the slight decreases in federal government spending over the past couple of years, and claimed that all economic growth has been a result of their monetary creation policy:

Taking into account the extent of federal fiscal retrenchment over the past year, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program as consistent with growing underlying strength in the broader economy.

The purchase of long-term debt and home mortgages has been termed “quantitative easing,” the third such attempt by the Federal Reserve Bank since the financial crisis shook the nation in 2007-08, and the indefinite time of the program has led to the label “QE-infinity.” The purchase of these debt instruments constitute a literal creation of money out of thin air, with just a few keystrokes of a computer. As such, they are by definition inflationary, though the upward pressure on prices in the U.S. market has been temporarily relieved by the foreign purchase of U.S. debt.

In a public statement, the Fed’s Open Market Committee noted:

The Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction.

The Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.

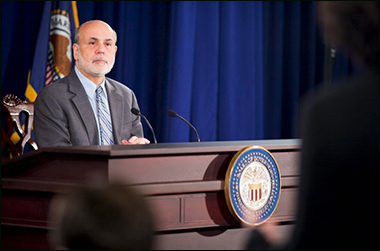

The Federal Reserve also announced on October 31 that its “liquidity swap” arrangements with six foreign central banks would become a regular policy. Liquidity swaps are essentially giant loans to foreign central banks, presumably with U.S. taxpayer money, but without authorization from the U.S. Congress. The October 31 press release contained no information about the extent of the loans or details about the loan arrangements, a trend of secrecy revealed in congressional hearings back in 2009. In 2009, Fed Chairman Ben Bernanke revealed his FOMC had loaned some $500 billion to foreign central banks without even consulting Congress, and incredulous congressional investigators such as Florida Democrat Alan Grayson asked Bernanke if it was consistent with the spirit of the U.S. Constitution for such sums (for example, $6 billion in loans to New Zealand, equating to over $1,300 for every man, woman, and child in that country) to be lent without informing Congress beforehand.

The idea of opening up the Federal Reserve to public scrutiny has seen a dramatic increase in support in Congress since that time. Last year, the House overwhelmingly passed the Federal Reserve Transparency Act by a 327-98 vote, though a vote was never held in the U.S. Senate. However, this year such a Senate vote may well come about.

Federal Reserve Transparency Act sponsor Senator Rand Paul (R-Ky.) has announced a filibuster attempt on the nomination of Dr. Janet Yellen (to replace Bernanke as chairman of the Open Market Committee) unless Senate Majority Leader Harry Reid consents to a vote on the bill. ”The American people have a right to know what this institution is doing with the nation’s money supply,” Paul wrote in a press release. “The Federal Reserve does not need prolonged secrecy — it needs to be audited, and my bipartisan Federal Reserve Transparency Act will do just that.”

No comments:

Post a Comment